ACD on the path to simplification

Electronic assistant

The electronic assistant on MyGuichet.lu will guide you through all the steps to complete and submit your tax return.

Submitting your electronic tax return allows the ACD to collect all the necessary data to enable it to pre-fill your declaration in the future, making your task easier and improving the quality of the data collected.

How it works:

- How do you fill out your tax return using the electronic assistant? - step 1

- How do you fill out your tax return using the electronic assistant? - step 2

- How do you fill out your tax return using the electronic assistant? - step 3

- How do you fill out your tax return using the electronic assistant? - step 4

- How do you fill out your tax return using the electronic assistant? - step 5

- How do you fill out your tax return using the electronic assistant? - step 6

- How do you fill out your tax return using the electronic assistant? - step 7

- How do you fill out your tax return using the electronic assistant? - step 8

- How do you fill out your tax return using the electronic assistant? - step 1

- How do you fill out your tax return using the electronic assistant? - step 2

- How do you fill out your tax return using the electronic assistant? - step 3

- How do you fill out your tax return using the electronic assistant? - step 4

- How do you fill out your tax return using the electronic assistant? - step 5

- How do you fill out your tax return using the electronic assistant? - step 6

- How do you fill out your tax return using the electronic assistant? - step 7

- How do you fill out your tax return using the electronic assistant? - step 8

Helpline

Our telephone support service is available to assist you in filing your tax return online.

For any tax-related questions, please use the contact form available on our website, acd.lu. Please note that the ACD does not act as an independent tax advisor.

We are available:

Monday to Friday, from 7:45 a.m. to 5:00 p.m.

ACD on Tour

"You ask, we answer"

The ACD is traveling to your region to answer your questions.

The ACD is launching an awareness campaign “Dir frot, mir äntweren” across the country to showcase the electronic assistant and the simple pre-filled tax return. Our experts will be happy to answer your tax-related questions and our HR department will be present to discuss current job opportunities.

Dates & places

Program:

- Presentation of the electronic assistant

- Presentation of the simple pre-filled tax return

- Presentation of vacant positions at the ACD

Our agents are on site to answer your questions!

-

Shopping Center Massen

- Adresse :

- 24 OP der Haart 9999 Wämperhaart Wäiswampech Luxembourg

-

COPAL Mertert-Wasserbillig

- Adresse :

- 20-24 Rte de Wasserbillig 6693 Wasserbillig Mertert Luxembourg

-

Belval Plaza Shopping Center

- Adresse :

- 7-14 Av. du Rock'n'Roll 4361 Esch-Belval Esch-sur-Alzette Luxembourg

-

Cloche d'Or Shopping Center

- Adresse :

- 25 Bd Friedrich Wilhelm Raiffeisen 2411 Gasperich Luxembourg Luxembourg

-

Belle Étoile Shopping Center

- Adresse :

- Rte d'Arlon 8050 Bertrange Luxembourg

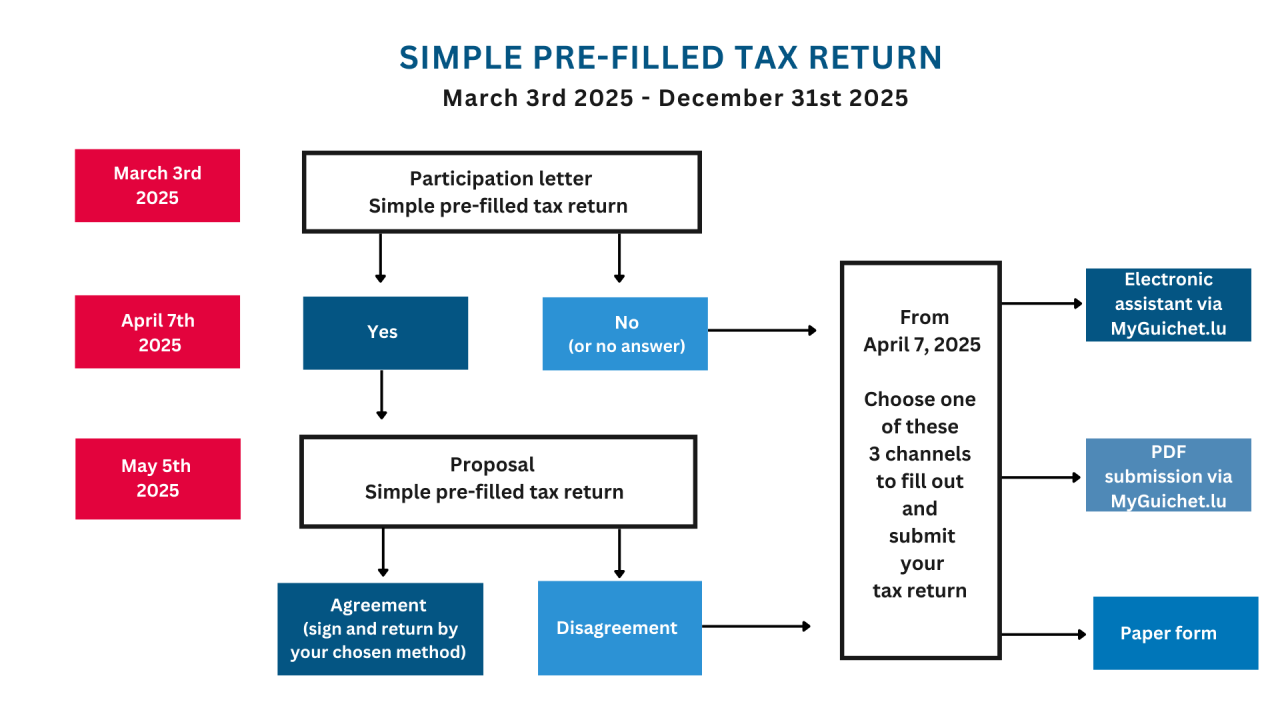

Simple pre-filled tax return

Thanks to the simple pre-filled tax return by the ACD, you no longer need to fill out your tax return yourself. You just need to check the information and submit it securely via MyGuichet.lu. Your data remain accessible online, offering you quick and simplified management.

At the beginning of March, eligible taxpayers received the option for a simple pre-filled tax return that is entirely pre-filled by the Direct Tax Administration.

What is a simple tax return?

The ACD will propose to eligible taxpayers a tax return based on known information. This simple tax return proposal includes the identification data and tax data known to the ACD, which are the salaries and/or pensions of each taxpayer.

Objectives of the simple tax return

As its name suggests, the purpose of the simple tax return is to simplify the procedures for taxpayers, allowing them to save time, because they no longer need to complete a tax return. Taxpayers need only to check the information already pre-filled.

In case data is incorrect or missing, taxpayers who have opted for a paper submission must file a tax return in the traditional way via MyGuichet or in paper format. Taxpayers who have opted for electronic submission in the MyGuichet personal space will be able to modify the data directly in the process.

Eligible taxpayers

Who is targeted by this procedure? For this year taxpayers are targeted, that are required to file an income tax return and have only “salary and pension” income, in absence of any further deductions outside the minimum flat rate (Model 100).

The profile of eligible taxpayers will be gradually expanded over the following years. Profiling will be assessed annually based on changes in taxation.

First step – March 2025 – participation letter

On the first Monday in March, eligible taxpayers will receive a letter inviting them to participate voluntarily on this ACD initiative. Taxpayers will have a deadline to sign this letter and indicate their agreement. They can also choose the language in which the simple declaration will be sent to them as well as the method of receipt, via their private MyGuichet space or in paper format.

- If the taxpayer has opted for the simple tax return, she/he will receive a pre-filled tax return proposal at the beginning of May, which she/he must check and validate.

- In absence of a response within the deadline or if the taxpayer indicates her /his disagreement, the taxpayer must make her/his declaration through the channel of her/his choice, via MyGuichet: ACD procedure (Model 100) or MyGuichet: ACD procedure (Model 100) – (PDF submission) or using the paper form, available from the first Monday in April onwards.

Second step – May 2025 – Control and validation of the tax return

Taxpayers who participated in this ACD initiative will receive a pre-filled tax return proposal at the beginning of May. This tax return must be checked, amended if necessary, signed and submitted.

- If the pre-filled tax return is correct, taxpayers can validate it and return it signed to the Direct Tax Administration without the need for any further action. They will receive their tax assessment and statement as soon as their tax office has processed the tax return.

- If the pre-filled tax return is incorrect or incomplete, taxpayers can modify it via via MyGuichet: ACD procedure (Model 100) or MyGuichet: ACD procedure (Model 100) – (PDF submission) or using the paper form and sending it back to their tax office. In this case the tax return is treated the same way as a classical tax return.

- In the absence of a response, the ACD assumes that the taxpayer no longer wishes to participate in the pre-filled tax return proposal. She/he must do a classical tax return via MyGuichet: ACD procedure (Model 100) or MyGuichet: ACD procedure (Model 100) – (PDF submission) or using the paper form.

FAQ

List for the most common 10 questions and their answers:

1. What is an electronic assistant?

The electronic assistant is a tool that allows you to complete your tax return directly online on MyGuichet.lu.

The benefits of the electronic assistant are numerous:

- it guides you step by step and adapts to your anwers;

- it pre-fills your salary and/or pension details;

- it offers automatic deferrals, explanatory tooltips and improved ergonomics;

- you no longer need an additional software such as Adobe Acrobat Reader

2. Where can I find the e-assistant?

Here is a direct link to the 2024 tax return: Income tax return (form 100)

3. How long does it take to complete your tax return using the electronic assistant?

Every tax return is unique, but a little preparation can help you complete it more quickly. It is advisable to gather and organize all relevant documents in advance, such as your annual salary or pension statements, insurance statements, interest records, and other relevant documents, so you have them readily available.

The electronic assistant will guide you step by step in filling out the correct fields. A tax return with salaries or pensions can typically be completed in less than an hour. Depending on your income sources, it may take longer, but once you have completed it once, the process becomes will become quicker in the future.

Additionally, certain fields for previous year (N-1) will be automatically pre-filled in the future. In many cases, you will only need to update specific amounts. For example, for third-party liability insurance, the line for N-1 is automatically saved for year N, so you only need to update the amount.

4. What do I need to complete my tax return with the electronic assistant?

You need access to a personal space MyGuichet on the site guichet.lu.

To register on MyGuichet.lu, you must have:

- a 13-digit Luxembourg national identification number (Matricule); and

- an email address; and

- your own authentication device, i.e.:

- a LuxTrust product; or

- a Luxembourg electronic identity card (eID); or

- an eIDAS device from another European country.

5. I have no pre-filled data, why?

Pre-filling is only done in cases where the ACD has sufficient individual data and in compliance with the rules relating to the protection of personal and sensitive data.

6. The data of my spouse/partner is not pre-filled, why?

For the moment, pre-filling is offered individually to each person in his or her MyGuichet space, and not to spouses/partners.

The ACD and the CTIE are working on expanding the functionalities to offer the possibility of mandates between spouses/partners.

7. When do I have to return my simple pre-filled tax return?

Upon receipt in May, you can return it if it is correct.

The deadline to return it is December 31, 2025.

Please find below a chart with the essential dates.

8. I did not receive an invitation for a simple pre-filled tax return. What do I need to do?

Only eligible taxpayers receive an invitation for a simple pre-filled tax return.

If you have not received a letter, you are not eligible for the simple pre-filled tax return and you must file your tax return by December 31, 2025 at the latest using the existing alternative channels, that are via the electronic assistant MyGuichet: ACD procedure (Model 100) or MyGuichet: ACD procedure (Model 100) – (PDF submission) or using the paper form.

The eligibility criteria are determined from the year N-1.

9. In which cases can I not use the electronic assistant for my tax return for 2024?

Starting from the tax return 2024, you will need to answer a series of questions to verify your eligibility for the online electronic tax assistant. If you do not meet the criteria, you will be redirected to a PDF or a paper declaration.

Here is a list of cases where you are not eligible:

- If you have no LuxTrust product

- If you have no national registration number

- For non-residents, if you want to revoke a previously filed request for collective taxation via assimilation

- For couples, if you request individual taxation

- If you have been married more than one during a year

- If you changed your country of residence during the year

- If you filed a request for an annual adjustment (form 163 R/NR)

- If you want to make a corrective tax return

10. Whom to contact in case of a question?

We have a helpline dedicated exclusively to questions about filing tax returns using the MyGuichet electronic assistant.

We will guide you through the process live. Our staff are there to:

- explain each field, even the most technical ones;

- help you avoid common errors;

- answer any other questions you may have about filling an income tax return via the electronic assistant on MyGuichet.lu.

Please note that the ACD does not act as an independent tax advisor.

If you have any other questions, please do not hesitate to contact us using the contact form: Contact form